Executive Summary

China has stated its ambition to become the world leader in artificial intelligence (AI) by 2030, a goal that encompasses not only the performance of individual AI models that often attract significant media attention but also AI innovation broadly and widespread adoption of AI for economic and geopolitical benefit. Based on an analysis of key industry pillars informing the US-China competition for AI supremacy including government and venture capital (VC) funding, industry regulation, talent, technology diffusion, model performance, and compute capacity Insikt Group assesses that China is unlikely to sustainably surpass the United States (US) on its desired timeline. Currently, China either trails behind or does not clearly lead the US in any of these pillars. The US-China AI competition is likely to become tighter, with China's AI industry likely being a close second to the US globally and its AI models possibly outperforming the US at times or in some sectors. Chinese generative AI models likely lag behind US competitors by approximately three to six months as of this writing, based on Insikt Group analysis of publicly available Elo benchmarks, but potential new algorithmic breakthroughs along with agentic and collaborative AI systems could significantly sway the competitiveness of US or Chinese models before 2030.

Chinas government has sought to accelerate the development of a world-leading, globally influential AI industry since 2017, when authorities adopted a dedicated plan for achieving this goal. DeepSeeks unveiling of R1 in January 2025 was a key milestone in this endeavor. R1s capabilities reflect and support continuing noteworthy advances and lines of effort within Chinas AI ecosystem. Chinas AI research community is very likely benefiting from the governments supportive policy environment, government-led investment initiatives, access to an increasingly high-quality talent pool, and increasing links between academia and industry. Chinese AI companies like DeepSeek have realized performance gains by innovating and embracing open source. These companies have also become proficient at adopting techniques implemented by US peers and domestic rivals and prioritizing cost efficiency to remain competitive in domestic markets. Chinese open-source models are being adopted domestically and abroad, while inventors and organizations in China are filing more patents for generative AI applications in many key industries such as software, finance, and energy.

Despite this progress, Chinas AI industry faces important challenges. Total private sector investment in AI lags far behind the US, and central government funding likely trails US federal investment by a small margin. Chinas access to domestic AI-relevant talent is improving and the attractiveness of its domestic industry is increasing, but it is still insufficient, and the US likely retains its historical advantages. Chinas regulations, although pioneering, likely create a drag on innovation for teams with any interest in making their products public. Moreover, Chinas semiconductor industry while achieving notable advances in spite of international export controls on specialized technology is still unlikely to meet the rapidly growing demand for AI accelerator chips.

Maintaining leadership in the race to artificial general intelligence (AGI) is almost certainly perceived in China and the US as critical to their national security. To this end, China is almost certain to continue applying its kit of licit and illicit tools for advancing national development, to include economic espionage and foreign talent recruitment. The US and allied governments should closely monitor major developments by Chinese generative AI companies and public and private investment in research and development (R&D), in addition to monitoring indicators of AI diffusion, such as applications and patents. Western AI companies should consider proactively protecting themselves from model distillation and intellectual property (IP) theft. Western hardware manufacturers subject to export controls should continue improving end-customer due diligence processes to remain compliant and avoid selling to proxies of entities sanctioned by the US. Western government, academic, and corporate entities should adopt policies that facilitate the recruitment and retention of global AI talent.

Key Findings

- Chinas rapidly maturing AI ecosystem is very likely increasingly fostering collaboration between government, industry, and academia, and is supported by steady advances in semiconductor manufacturing.

- Government funding for AI-related technologies is likely on an upward trajectory in both the US and China as of early 2025, and Chinas overall government-led funding likely exceeds investment by US federal and state governments; however, total private-sector investment in AI companies in the US vastly outmatches private-sector investment in China.

- Chinas regulatory scheme likely hampers Chinese AI capabilities and extends development and deployment timelines but only among developers aiming for public-facing products, meaning frontier advancements are unlikely to be impeded.

- The international AI talent pool likely continues to favor the US due to a continuing though declining immigration advantage and the quality of elite educational institutions, but the practical implications of this lead for AI competition are likely eroding.

- AI diffusion rather than innovation will very likely determine the winner in the competition to economically and geopolitically benefit from the technology, but whether the US or China has greater levels of diffusion is unclear, with one metric (patents) nevertheless showing China has a lead in many industries.

- According to Insikt Group's analysis of model benchmarks, Elo scores, and industry expert assessments, Chinese generative AI models likely now have a three to six-month performance gap behind US rivals, though this time lag is shortening.

- Closing the performance gap while being cost-competitive is very likely to pay off for China by driving the adoption of Chinese generative AI models domestically and abroad.

- Access to high-quality training data and IP is an increasingly contested domain where the US likely retains a competitive advantage; companies in both countries are likely leveraging user-generated content (UGC) to train generative AI models.

- Adopting open source is more prevalent among Chinese AI companies and likely enables China to diffuse its models more broadly than US proprietary models.

- US export controls have also almost certainly prompted the Chinese government to accelerate funding for its AI hardware and semiconductor industries and high-performance computing infrastructure for training and hosting AI models.

- Chinas semiconductor industry likely still faces a bottleneck in producing sub-7 nanometer (nm) chips, and it is almost certainly attempting to develop its own extreme ultraviolet (EUV) lithography tools using alternative techniques to advance domestic AI accelerator production.

- Although the current US presidential administration has signalled that maintaining the USs leading position in AI development is a priority, early actions to decrease public funding for science and target international students over alleged visa infractions likely risk undermining this goal.

Background

The race to AGI, which is estimated by AI experts and industry leaders to be concluded within the next five to ten years, holds considerable stakes for national security and economic growth. A declining costand general availability of human-level AI models meaning that AI can perform most tasks previously done by humans, better than humans will very likely disrupt the future of work while simultaneously leading to explosive economic growth, with AI estimated to contribute $15.7 trillion to the global economy by 2030. Researchers continue debating the existential risks and adversarial use of AI, ranging from facilitating chemical, biological, radiological, and nuclear (CBRN) threats to targeting democratic processes and supporting offensive cyber operations. The notion of AI supremacy captures the geopolitical stakes of the AGI race, with the US and China considered by many to be forerunners.

On January 20, 2025, Chinese AI research company DeepSeek released R1, an open-source reasoning large language model (LLM) competing with OpenAIs then state-of-the-art o1 model. The following week, US AI hardware company Nvidia subsequently lost $593 billion in market value, marking the single largest market capitalization loss in US history. Media headlines compared DeepSeeks release of R1 to the Space Races Sputnik moment, referring to a rapid and unexpected shift in perceived adversary capabilities following the Soviet Unions surprise launch of the Sputnik satellite into orbit on October 4, 1957.

The US-Soviet missile gap theory is a likely more accurate Cold War analogy of current threat perceptions. Like missile production, the AGI race is not measured solely by innovation capacity (launching Sputnik) but also diffusion capacity, or the ability of national ecosystems to align capital, talent, and policies to rapidly convert innovations to economically productive processes (winning the Cold War). The missile gap analogy is also accurate insofar as US leaders long possessed inaccurate data on Soviet missile capabilities; it was only by 1961 that innovations in satellite imagery allowed decision-makers to obtain reliable data on this so-called missile gap. Following the launch of the CORONA satellite project to monitor Soviet ICBM capabilities and Chinese nuclear testing, US President Lyndon Johnson admitted in 1967: We've spent $35 billion or $40 billion on the space program. [...] We were doing things we didn't need to do. We were building things we didn't need to build. We were harboring fears we didn't need to harbor. Similarly, advances (whether real or speculative) in Chinese AI development are very likely fueling funding for AI research in the US, where AI capital expenditure is projected to reach over $320 billion in 2025, and influencing opinions on issues like AI regulation.

Maintaining an accurate threat perception of Chinese AI will almost certainly be key for major business and national security decision-makers in the US and its partners in the coming years. Despite the public perception of sudden and opaque progress via the lens of a Sputnik moment," the development of Chinas AI ecosystem almost certainly bears the fruit of long-term investments, iterative innovation, and the necessity for efficiency gains in the face of hardened chip export controls.

Chinas AI Industry and Landscape

In July 2017, Chinas State Council issued the New Generation Artificial Intelligence Development Plan (AIDP; ), which outlined an ambitious path to achieving world-leading AI theories, technologies, and applications and becoming the worlds primary AI innovation center by 2030. To achieve these goals, the AIDP calls (in part) for the activities listed below. The AIDP also outlined key challenges China faced at the time and to some extent continues to face including a lack of breakthroughs in basic AI theory, algorithms, high-end chips, and other resources and outputs. Since that time, Chinese universities and businesses have become increasingly involved in AI conferences at the frontiers of AI research and have released hundreds of generative AI models. At the same time, Chinas semiconductor industry is steadily advancing its capabilities in spite of international restrictions.

According to the AIDP, China would seek and in many ways has begun, as documented in this report to:

- Support a development framework that enables industry, academia, and other sectors to pursue joint and cross-disciplinary innovation

- Seek breakthroughs in R&D, applications, and overall industry, including along the AI-relevant industrial chain

- Improve training and recruitment of talent, focusing on AI specifically as well as AIs application in other fields

- Promote AI applications and AI-related innovations across industries, enterprises, and services

- Coordinate support for AI across Chinas main science and technology (S&T) pillars, including key programs, megaprojects, bases, and talent plans

- Adopt a system of laws, regulations, and norms to aid the development of AI

- Disseminate news of Chinas AI progress to foster a society enthusiastic about, and supportive of, AI development

Chinas S&T innovation apparatus very likely emphasizes (though it is perceived to be deficient in) collaboration among government including laboratories and state-owned enterprises [SOE]) industry, and academia. Accordingly, entities from each of these sectors contribute to Chinas AI development enterprise. Entities from all three sectors are increasingly producing noted contributions to AI R&D and applications. Contributions to theoretical research can be observed in scholarly papers accepted to the prestigious AI-focused Conference on Neural Information Processing Systems (NeurIPS) since 2021. Table 1 lists examples of government, industry, and academic entities from among the top fifteen institutions named as the affiliation of one or more co-authors on papers accepted by the conference (20212024). Note that there are no top-fifteen NeurIPS contributors from China that are SOEs; two are included in Table 1 to indicate that some SOEs are nevertheless attempting and occasionally succeeding to contribute to frontier AI advancement.

| Sector | Entity | No. of Papers (Rank) |

|---|---|---|

| Academia | Tsinghua University | 643 (1st) |

| Academia | Peking University | 458 (2nd) |

| Industry | Huawei Technologies | 228 (6th) |

| Industry | Tencent AI Lab | 197 (7th) |

| Government (Research Institute) | Shanghai AI Laboratory | 141 (11th) |

| Government (Research Institute) | Institute of Automation of the Chinese Academy of Sciences | 118 (12th) |

| Government (SOE) | Intelligent Science and Technology Academy of China Aerospace Science and Industry Corporation | 9 (N/A) |

| Government (SOE) | China Telecommunications Corporation | 2 (N/A) |

Shanghai AI Laboratory (SHLAB; ) exemplifies how Chinas S&T system supports inter- and intra-sector collaboration. SHLAB was created in 2020 as an almost certainly state-affiliated new-type scientific research institution (). Described as a large-scale comprehensive research base (), SHLAB offers open-source information repositories and platforms that facilitate AI development in specific areas. For example, its OpenMMLab is an open-source computer vision algorithm system that seeks to facilitate academic and industry applications; it claims to have users from more than 100 countries and territories (Figure 1 shows reported user affiliations). SHLABs website further asserts strategic partnerships with at least thirteen universities across China. The research institution is also a significant contributor to Chinas technical research on AI safety, and it has also begun producing accompanying policy papers to advance AI safety. In July 2023, Chinas National Artificial Intelligence Standardization General Working Group () announced the creation of a large model-focused working group () led by SHLAB and comprising the companies Baidu, Huawei, Qihoo 360, China Mobile, iFlytek, and Alibaba.

Figure 1: Institutions reportedly using or affiliated with users of OpenMMLab as of September 2024 (Source: OpenMMLab)

Figure 1: Institutions reportedly using or affiliated with users of OpenMMLab as of September 2024 (Source: OpenMMLab)

According to information released by the Cyberspace Administration of China, 302 generative AI service models are fully registered in China as of January 2025. Noteworthy frontier model companies contributing to Chinas LLM capabilities most often from the private sector, with some seen in the NeurIPS data include DeepSeek, Alibaba, Baidu, 01.AI, Tencent, Stepfun, ByteDance, Infinigence AI, and ModelBest. Signifying the important role of academia-industry linkages, Chinas new AI tigers Baichuan AI, MiniMax, Moonshot AI, and Zhipu AI were founded by Tsinghua University faculty and graduates.

Chinas semiconductor industry plays a key role in supporting the countrys ecosystem for AI development, which is almost certainly critical to achieving the AIDPs goals. Faced with explicit efforts by the US to curtail Chinas advances in both AI and semiconductors, Chinas support including financial support for the domestic semiconductor industry has almost certainly accelerated. One vehicle of state-led investment, the multi-phase China Integrated Circuit Industry Investment Fund (Big Fund; ) had minority ownership in at least 74 domestic semiconductor companies as of February 2023. Huawei is a particularly important and rising contributor to Chinas semiconductor industry, but multiple Chinese companies are making progress or experimenting with methods (Table 2) that while far from cutting-edge capabilities and likely currently insufficient for domestic demand likely have the potential to alleviate Chinas dependence on the US and others in the long term. In March 2025, Bloomberg reported (citing unnamed sources) that Chinas Ant Group had found a way to train AI models using domestically produced chips at a cheaper cost but with similar results compared to those obtained by using US chips.

| Chinas Semiconductor Development |

|---|

| Huawei is now mass-producing 7-nanometer (nm) Ascend 910B and 910C AI chips, marking significant progress despite yield rates reportedly at only 40% though Huaweis yield was reportedly at 20% only a year before. |

| China is now forecasted to become the worlds single largest source of IC wafer manufacturing by 2026, likely led by growth in 12-inch wafer fabs by Big Fund investees like Semiconductor Manufacturing International Corporation (SMIC), Hua Hong Semiconductor, Runpeng Semiconductor (, a subsidiary of China Resources Microelectronics), Tiancheng Advanced (), Yandong Microelectronics (), and Zensemi (). |

| Chinese companies are currently exploring alternative techniques to manufacture extreme ultraviolet (EUV) lithography equipment, with patents by the Harbin Institute of Technology () and Shanghai Micro Electronics Equipment (SMEE, ) exploring laser-induced discharge plasma (LDP, ) and laser-produced plasma (LPP, ) EUV sources, respectively. |

| China is progressing on domestic production of deep ultraviolet (DUV) lithography equipment, including recent breakthroughs in domestic manufacturing of DUV photoresists by Hubei Dinglong () and Shenzhen Rongda (). |

Economic espionage, whether state-led or otherwise, also very likely supports Chinas progress in advancing its AI and semiconductor industries. It would be inaccurate to attribute all progress to this activity, but government-directed and tacitly allowed espionage almost certainly remains an important instrument in Chinas toolkit for achieving modernization. In October 2023, intelligence leaders of the Five Eyes alliance noted AI as one sector targeted by Chinas illicit actions. In February 2025, the US Department of Justice indicted a former software engineer at Google over alleged attempts between mid-2022 and mid-2023 to steal proprietary information on hardware and software enabling supercomputing in support of large AI models. The engineer allegedly intended to use the information to support his own and another early-stage AI-related company. In November 2024, a former employee of South Koreas SK Hynix Inc. was convicted of printing and seeking to retain proprietary documents on semiconductor manufacturing solutions in mid-2022, likely to facilitate her role in a new position at Huawei. Although not always a form of espionage, Chinas AI sector very likely further benefits from concerted efforts to attract and recruit foreign talent. Additionally, there is evidence that Chinese companies have circumvented foreign platforms terms of service to enhance their own models through model distillation techniques.

Government and Venture Capital (VC) Funding

Funding for AI-related technologies is likely on an upward trajectory in both the US and China as of early 2025. Direct comparisons are difficult due to definitional issues and especially with regard to China data intransparency, but US federal government funding for civilian (non-military) AI likely exceeds the Chinese central governments funding by up to several billion USD per year, especially in light of evidence of declining expenditure by Beijing until approximately 2023 (likely in part due to COVID-19). The balance of government-led investment when including activity at the state and provincial levels likely leans in Chinas favor, where guidance funds combine public and private capital to invest approximately $16 billion annually in likely AI-related companies (broadly defined). Total private-sector investment in AI companies in the US far outstrips private-sector investment in China.

According to Federal Budget IQ, the US federal government has increased its AI and IT R&D spending from $8.2 billion in 2021 to $10.4 billion in 2024, a nearly 27% increase. The 2025 fiscal year budget earmarked $11.2 billion for AI and IT R&D spending. Removing spending by the US Department of Defense (DoD; $2.035 billion) and the Defense Advanced Research Projects Agency (DARPA; $1.41 billion), US federal spending on AI and IT R&D for civilian applications represents approximately $7.33 billion. Within this, the budget for core AI ($1.955 billion) is the largest component, though funding for the likely AI-relevant area of high-capacity computing is also rising quickly. The US federal budget for core and cross-cut AI in fiscal year 2025 combined is $2.8 billion (excluding US DoD and DARPA).

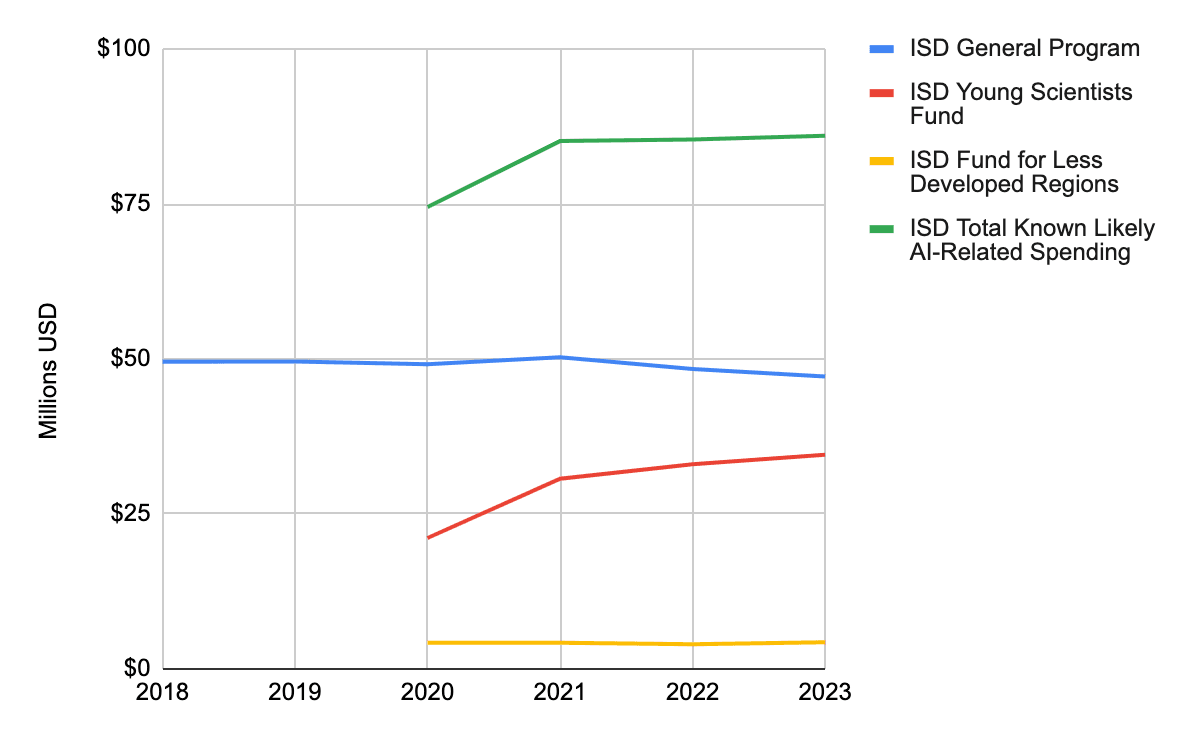

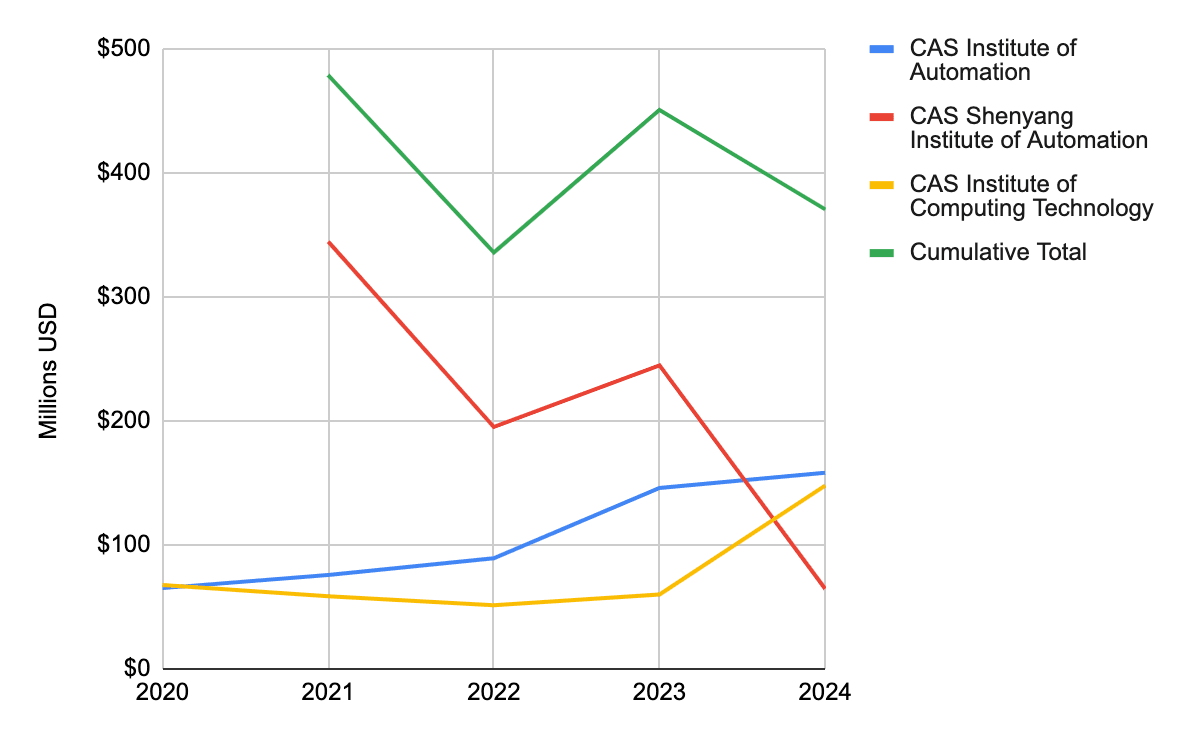

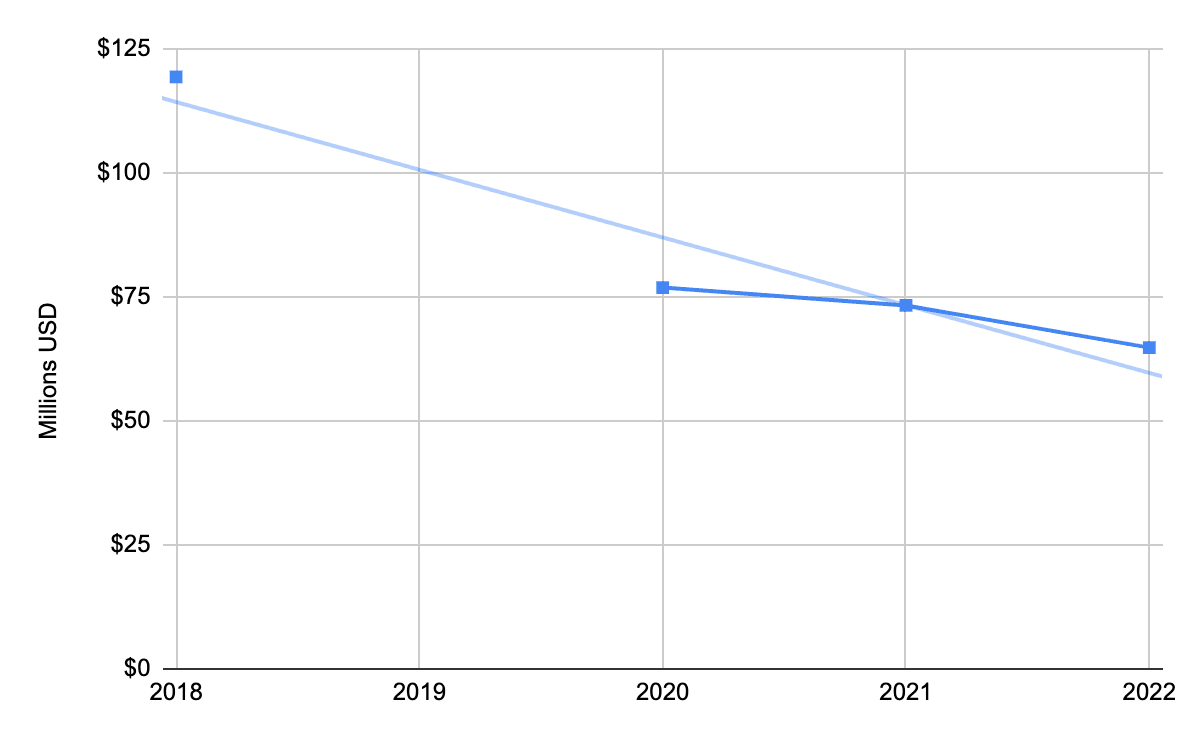

In China, total central government funding for AI is much more opaque. Figure 2 and Figure 3 show likely AI-related investment in basic, applied, and experimental R&D over recent years for two of Chinas largest government-run institutions: the National Natural Science Foundation of China (NSFC) and the Chinese Academy of Sciences (CAS). Specifically, Figure 3 presents data from the budgets of three CAS institutes particularly focused on AI. Figure 4 shows notionally earmarked funds for research to be conducted under Chinas New Generation Artificial Intelligence Megaproject ( 2030). In addition to these data points and trends, the two organizations supervising nearly half of Chinas state key labs (SKLs) the Ministry of Education and CAS cumulatively budgeted 2.4 billion RMB ($327 million) under associated R&D line items. Of this, approximately 29% would go to SKLs in the information and communications technology field, assuming funds were distributed equally among all SKLs supervised by these organizations and not accounting for other known unknowns.

Insikt Groups review of the data summarized above and evidence from other central government funding channels leads us to a low-confidence estimate that Chinas central government spends on the order of several billion USD annually on likely AI-related R&D, roughly similar to the US governments spending on core and cross-cut AI (excluding US DoD and DARPA). Because core and cross-cut AI have a clear definition and estimating Chinas funding relies on imperfect visibility into the research program it targets, it is likely that US federal government funding for AI is higher than that of Chinas central government. Total Chinese government-led investment in AI via guidance funds likely exceeds US cumulative federal and state investment, however (discussed further below).

Figure 2: NSFC National Natural Sciences Fund Information Science Department (ISD) R&D expenditures (actual) for AI and automation, 20182024 (RMB all years converted to 2025 dollars) (Source: Insikt Group)

Figure 2: NSFC National Natural Sciences Fund Information Science Department (ISD) R&D expenditures (actual) for AI and automation, 20182024 (RMB all years converted to 2025 dollars) (Source: Insikt Group)

Figure 3: R&D expenditures (20182023 actual; 2024 budgeted) for AI-focused CAS research institutes, 20182024 (RMB all years converted to 2025 dollars) (Source: Insikt Group)

Figure 3: R&D expenditures (20182023 actual; 2024 budgeted) for AI-focused CAS research institutes, 20182024 (RMB all years converted to 2025 dollars) (Source: Insikt Group)

Figure 4: Annual proposed funding for projects announced under the New Generation Artificial Intelligence Megaproject, 2018 and 20202022 (data not available for 2019; RMB all years converted to 2025 dollars) (Source: Insikt Group)

Figure 4: Annual proposed funding for projects announced under the New Generation Artificial Intelligence Megaproject, 2018 and 20202022 (data not available for 2019; RMB all years converted to 2025 dollars) (Source: Insikt Group)

The declining trend through the early 2020s is likely related to the impact of COVID-19 on Chinas economy, but should also be viewed cautiously given missing data from other central government funding channels. As of early 2025, central government actors have signaled increasing interest in AI. In January 2025, Bank of China announced a five-year plan for financially supporting the AI industry value chain with a minimum of one trillion RMB ($138 billion). In March 2025, Chinas National Development and Reform Commission announced the establishment of a National Innovation Investment Guidance Fund (). The new fund is being dubbed an aircraft carrier-level () fund and will seek to raise one trillion RMB ($138.2 billion) while focusing investment on start-up, early-stage, small-, and medium-sized enterprises in frontier domains like AI, quantum science, and future energy. Indicating its focus on the concept of patient capital," the funds duration is being set at twenty years reportedly about five years longer than most other guidance funds.

Government guidance funds, such as the one announced in March 2025, have been established at multiple levels of government in China and mix funds from governmental and non-governmental sources (including corporate sources). This creates a challenge when attempting to isolate just central government funding. However, research published by the National Bureau of Economic Research (NBER) has found that more broadly across central, provincial, and local governments, these guidance funds have invested in 9,623 unique AI firms through more than 20,000 transactions, in total 184 billion USD between 2000 and 2023, with the majority of transactions occurring since 2013. Annualizing this estimate over the 20132023 period points to an average spend of $16.7 billion per year, though the NBER studys method of identifying AI companies was very broad and potentially leads to an overestimate. There are state-level initiatives in the US, such as New Yorks Empire AI consortium that has received $565 million in funding from public and private sources, but they likely do not match sub-national funding in China, which is steadily increasing. In January 2025, two state-backed Chinese investment companies announced the creation of a National Artificial Intelligence Industry Investment Fund () with an initial registered capital of 60 billion RMB ($8.2 billion).

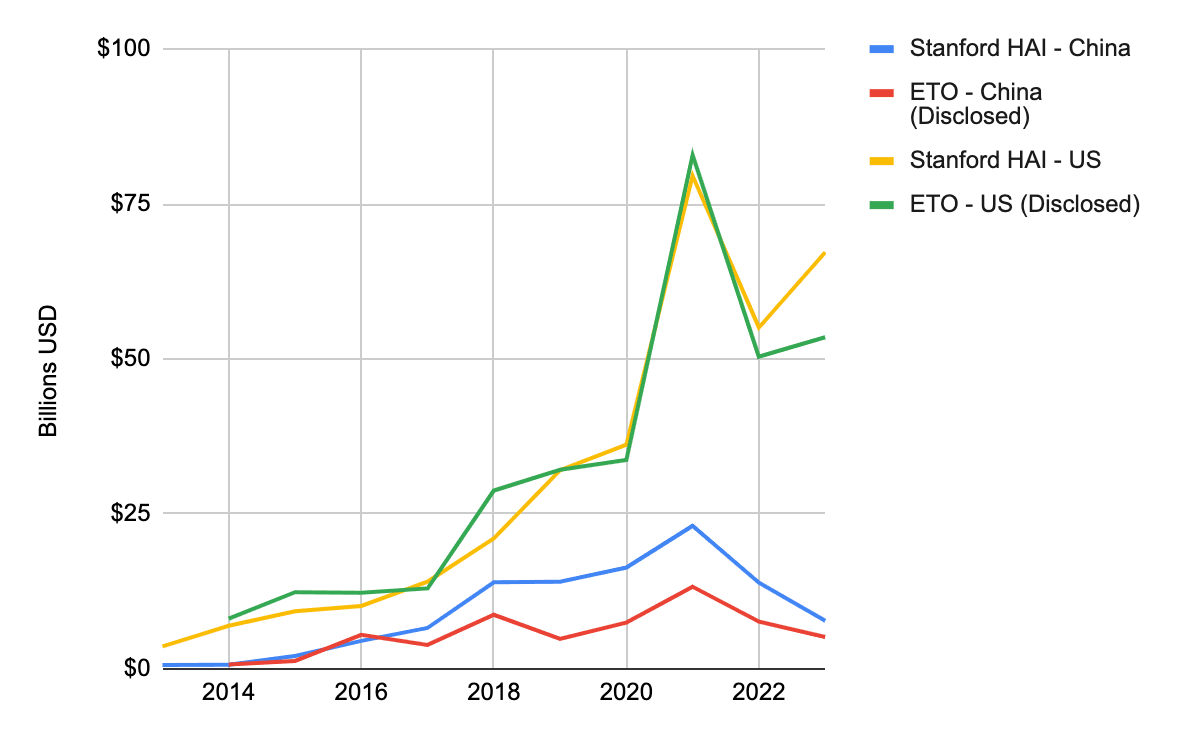

Although Chinas government may be ahead in terms of total AI investment when the likely small lag in central government spending is compared to the likely larger lead in sub-national investment through guidance funds total private-sector investment in AI companies in the US vastly outmatches private-sector investment in China. This is seen in data (Figure 5) collected by both Stanford Universitys Center for Human-Centered Artificial Intelligence (Stanford HAI) and the Emerging Technology Observatory (ETO), a project under Georgetown Universitys Center for Security and Emerging Technology (CSET). Note that there is likely overlap between the aforementioned investments of Chinas guidance funds and the private-sector investment data; that is, this data likely does not exclude investments in AI companies that come from government sources. This private-sector investment data is narrower, however; ETOs data only reflects investments into 2,100 Chinese AI companies compared to the NBER studys over 9,000 companies.

Figure 5: Disclosed private-sector investment in China and the US, 20132023 (Sources: Stanford HAI; ETO)

Figure 5: Disclosed private-sector investment in China and the US, 20132023 (Sources: Stanford HAI; ETO)

To read the entire analysis, click here to download the report as a PDF.

Source: RecordedFuture

Source Link: https://www.recordedfuture.com/research/measuring-the-us-china-ai-gap